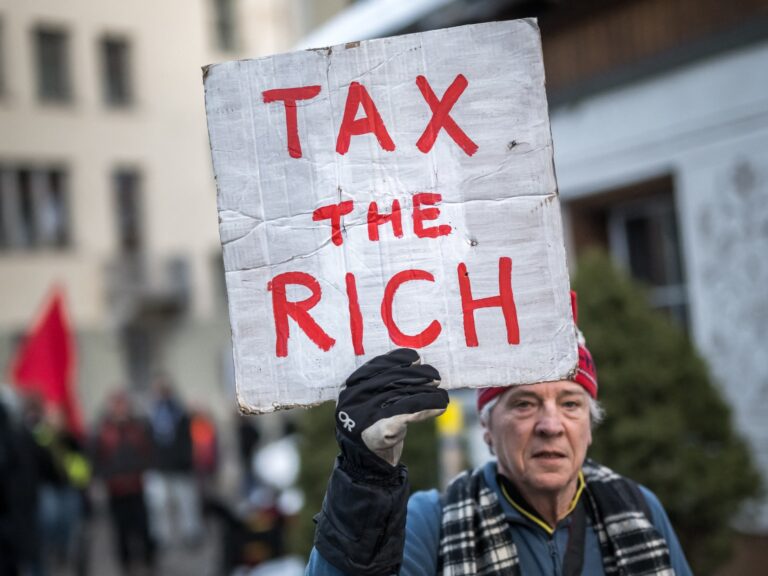

Calls to abolish billionaires, or at least curb their growth, have gained traction across many capitals in the West, where extreme wealth has risen to unprecedented levels.

Elon Musk’s pay award of a potential $1 trillion in November will make the Tesla owner not just the richest person in the world, which he already is. If Musk gets the full pay package, he will become the richest person in history.

Recommended Stories

list of 4 itemsend of list

Musk would soar ahead of the world’s other billionaires – a record 3,028 of them, according to Forbes magazine, estimated to be sitting on $16.1 trillion of global wealth.

The difference between the world’s rich and poor hasn’t been so stark since the peak of Western imperialism in the early 20th century.

Currently, about 831 million people live at or below the level of extreme poverty across the globe. According to the World Bank, that’s $3 per day when adjusted for currency and cost of living.

In fact, if every billionaire were left with only a billion dollars to their name, the rest of their seized wealth would be enough to cover the amount UN experts believe is needed to end world extreme poverty for the next 196 years.

According to some analysts and economists, the wealth owned by billionaires can skew the world’s politics, media, and even the way we think, to reflect the interests of the super-rich.

Others argue that this epic wealth benefits the global economy by ensuring that the world’s innovators and creators have the funds they need to spearhead new technology and innovation.

So, what if we got rid of the world’s billionaires and redistributed their wealth, or capped people’s earnings below a billion dollars?

What would that look like? Would we think of the world differently? Would our institutions improve, or would we all lose the globe’s leading wealth creators and investors?

We asked some of the world’s leading economists and social campaigners for their opinions.

Would innovation stop?

The abolition of billionaires is a nonsensical idea, and if it were to happen in a fantasy-scape, it would spell complete disaster for our developed economies.

The vast majority of billionaires in the West created the immense wealth that they now own … simply through the creation of products, services, and other items which we as a society have freely purchased.

“Billionaires” are individuals who have wealth exceeding $1bn – this consists of shares in companies, ownership of intellectual property (IP), land, property, or tangible goods. The wealth they have is theoretical – they do not sit on a bank pile of 1 billion $1 notes, nor do they have a swimming pool of gold bullion.

Many of the billionaires we know may be worth a billion today or a million tomorrow, depending on how these shares or IP perform. This may sound elementary, but it is important.

Billionaires have an inherent interest in growing their wealth and therefore to grow productive, profitable, problem-solving companies.

See Nvidia, which issues shares to its staff and is at the forefront of the AI revolution, or SpaceX, which has opened up satellite communication for the masses and benefits us all.

Now, let us invert this issue – if we abolish billionaires, these exceptional individuals do not have the incentive to fix these problems, we all lose utility, and problems remain.

That would be a terrible thing for society.

Maxwell Marlow, director of public affairs, Adam Smith Institute

What if wealth was fairly distributed?

Billionaires need to be taxed — but from the perspective of the Global South, the real question is where.

Firstly, it should not be looked at as the Robin Hood type of distribution. Secondly, if they are taxed only in their country of residence, does that reflect where their wealth was actually created?

Wealth is not produced solely by investment. It is built on resources and labour. In today’s global economy, much of that comes from the Global South. It follows, then, that tax revenues should also flow back to the places from which that wealth is extracted.

Take Antwerp. It is a beautiful city whose residents enjoy high living standards. But the foundations of that prosperity lie in diamonds from the [Democratic Republic of the] Congo, where living standards have barely risen. We have to ask why we have these different outcomes. This is not about charity; it is about restructuring global finance to make it fair.

Inequality has surged over the past 30 to 40 years. Extreme wealth of the kind we see today was taxed at 97–98 percent in the form of high marginal tax rates above a threshold, based on what amounted to a global consensus that such concentrations of wealth were unhealthy — and that the money was better directed to health, welfare and education.

Today, in moments of economic crisis, governments often impose austerity, pushing the burden onto the poor and middle class. That shift is new.

We need structural change — not simply new billionaire taxes. Otherwise, we face an existential problem if we leave the structures that reproduce inequality intact: individuals whose wealth gives them more power than many governments.

Extreme wealth is concentrating, becoming a political force, and entrenching an oligarchic system replicated worldwide — including in the Global South, where much of that wealth originates.

Consider the Millennium Development Goal to eliminate cholera. The vaccine costs about $2. Multiply that by the number of people at risk and the disease should disappear.

But it doesn’t work that way. Without changing living conditions, people remain exposed. Redistribution must work the same way: it must change structures, not just transfer funds.

Dereje Alemayehu, executive coordinator, Global Alliance for Tax Justice

Would regulations need to change?

If we got rid of the billionaires tomorrow, I can guarantee we’d have a new class of billionaires by the following week.

Billionaires are the product of policy failure. It is absurd that they exist at all, yet the system is designed to enable precisely this concentration of wealth. It is built not to deliver equality, sustainability or environmental justice, but to serve the interests of billionaires.

Many of my progressive colleagues talk about redistribution – taxing billionaires to fund healthcare, environmental reforms and other public needs. But that misses the core problem.

Consider taxing alcohol or cigarettes to pay for healthcare. The logic becomes perverse: the more people smoke or drink, the more revenue you have.

The same applies to billionaires. The more wealth we allow them to accumulate, the larger the “tiny little slice” of tax we depend on. In effect, we end up asking billionaires for permission to fund the public good.

If we are serious about eliminating billionaires, we need to regulate them out of existence. It is no coincidence that much of the West’s antitrust legislation is centuries out of date. These laws allow billionaires to flourish.

We need modern regulation – and we need to separate spending decisions from both regulation and taxation.

Only then do we stand a chance of building a fair, just and inclusive society that reflects the values of the people within it.

Fadhel Kaboub, associate professor of economics at Denison University, president of the Global Institute for Sustainable Prosperity, and author of Global South Perspectives on Substack.

The idea of simply getting rid of billionaires raises a series of interconnected questions.

First, billionaire ownership of the media is far from hypothetical. It has long existed … but today we have individuals who can buy entire media platforms outright, simply because they have the cash. Think of Jeff Bezos or Elon Musk.

Naturally, this changes the information we receive and who determines what that is.

Second, billionaires sometimes claim they are rescuing news organisations and supporting journalism, but that commitment lasts only as long as their own interests go unchallenged and as long as they find it personally profitable or useful.

Musk, for example, has taken one of the world’s most important platforms [the social media platform X, formerly Twitter] — at least for journalism — and arguably corrupted it in pursuit of his political preferences.

It is essential to remember that controlling the media is ultimately about controlling access to information. That is why you very rarely see meaningful scrutiny of the interests of media owners themselves.

Des Freedman, co-director, Goldsmiths Leverhulme Media Research Centre

Is it possible to abolish extreme wealth?

Across much of the West, wealth and power are becoming increasingly concentrated. Yet there are also strong reasons to believe this era of concentration may be nearing its end.

Extreme concentrations of wealth are not new, and they have been curbed before. In the 1910s, the US broke the conglomerate of John D Rockefeller — then the world’s richest man and effectively the tech giant of his era. Then [President Franklin Delano] Roosevelt … introduced [in 1944] a 94 percent top tax rate on extreme incomes.

Roosevelt also helped finance the New Deal, which is often credited with pulling the US out of the Great Depression.

In recent years, growing transparency has fuelled renewed pushback against extreme wealth in a context of economic discontent. Disclosures such as the Panama Papers and LuxLeaks have stripped away much of the opacity surrounding it. In France, serious proposals to tax billionaires and centi-millionaires now command broad political support. Within the G20, President Luiz Inacio Lula da Silva has placed taxing the super-rich firmly on the agenda. The debate is no longer about whether the ultra-wealthy can be taxed, but when.

Winning that argument will not be easy. But, as with income tax — once denounced as Marxist — it has been won before. And redistributing some of the wealth held by the super-rich would also weaken many right-wing nativist narratives about scarce resources that have spread across the West.

Those narratives have prospered partly because progressive calls for redistribution have lacked the necessary weight, enabling an alliance of the right and billionaire interests to push xenophobia to the fore.

Lucas Chancel, senior economist at the World Inequality Lab of the Paris School of Economics