Warner Bros. Discovery is in the middle of a Hollywood tug-of-war between Netflix and Paramount. And chances are it’ll be a long, bumpy regulatory road ahead for either buyer.

Warner’s board on Wednesday urged shareholders to back the deal it struck with Netflix to sell its studio and streaming business for $72 billion. Meanwhile, Skydance-owned Paramount is moving forward with its hostile $77.9 billion bid for a full takeover of the company, including networks like CNN.

In both scenarios, a merger would likely trigger a review by the U.S. Justice Department, which could sue to block the transaction or request changes. But other countries and entities could challenge either acquisition, too.

Politics are also expected to come into play under U.S. President Donald Trump, who has made unprecedented suggestions about his personal involvement on whether a deal will go through.

The process could drag on for more than a year, if not longer. But regardless of who wins, new ownership of Warner properties would drastically reshape the industry — impacting movie-making, streaming platforms and the broader media landscape.

Here’s what we know.

A look at the players

The buyout target — Warner Bros. Discovery — is a 102-year-old Hollywood giant. It is one of the “big five” studios, producing titles ranging from “Harry Potter” to “Superman.” And its cable operations include top networks like CNN and Discovery. Warner also owns DC Studios and HBO Max.

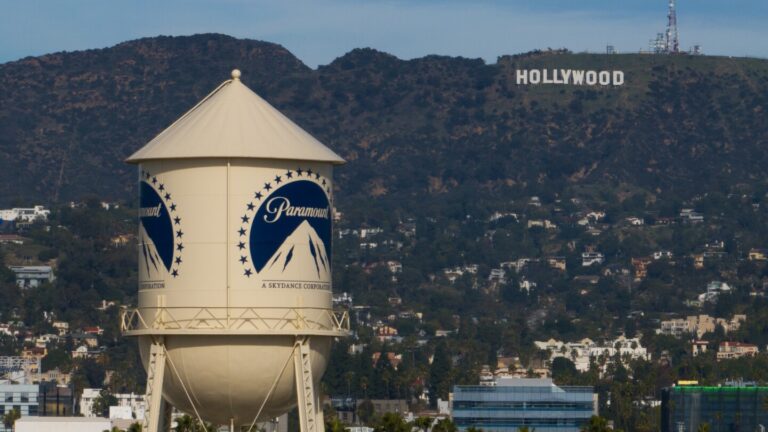

Paramount, which closed its own $8 billion merger with Skydance just months ago, is also one of Hollywood’s remaining legacy studios — with a blockbuster lineup including “Top Gun” and “The Godfather.” Beyond traditional film and TV production, it owns networks like CBS, MTV and Nickelodeon, as well as the Paramount+ streaming service.

An aerial view shows Paramount Pictures in Los Angeles, Thursday, Dec. 18, 2025. (AP Photo/Jae C. Hong)

For Netflix, streaming is its bread and butter, accounting for 20% of the U.S. market for on-demand subscriptions, according to data from streaming guide JustWatch. That compares to 13% for HBO Max and 7% for Paramount+. But Netflix has also built up its own production arm, rolling out popular titles like “Squid Game” and “Stranger Things.”

Netflix is the biggest of the three companies, with a market capitalization of around $430 billion as of mid-December. Warner Bros. Discovery is about $70 billion, while Paramount Skydance trails at closer to $14 billion.

Regulatory hurdles for Netflix vs Paramount

Paramount has already pointed to Netflix’s streaming dominance, arguing that bringing the platform under the same roof as HBO Max would squash competition and give it “overwhelming” market share. But Netflix has maintained its merger will give consumers more choice, allowing it to offer more plans and titles for customers to choose from Warner’s catalog.

Antitrust experts expect Paramount and Netflix to try to convince regulators that they’re not just up against more traditional rival subscriptions, but broader video libraries across the internet.

A Netflix sign is displayed atop a building in Los Angeles, Thursday, Dec. 18, 2025. (AP Photo/Jae C. Hong)

YouTube is at the top of the list and Netflix is already laying the groundwork to show Google’s streaming platform dominance in terms of viewing hours, which, according to media analytics firm Nielsen, accounted for nearly 13% of viewership this fall compared with 8% for Netflix.

Jim Speta, a professor at Northwestern University’s Pritzker School of Law, expects both companies to say that a merger is “necessary for them to compete against YouTube.”

“The broader you make the market that we’re thinking about, the less the merger looks anti-competitive,” Speta said.

Meanwhile, others will argue that either merger is bad for consumers. While content libraries may broaden, a case could be made about a combined company wielding its power to control prices — or adding more subscription hoops for consumers to jump through to watch certain titles.

Among concerns, “the range of available content on the streaming services might decrease,” said Scott Wagner, head of antitrust practice at law firm Bilzin Sumberg. He pointed to older movies in particular that could potentially see shorter streaming windows across platforms.

Implications for studio production and news

If successful, Paramount’s takeover would combine two of Hollywood’s “big five” studios. And while Netflix has agreed to uphold Warner’s contractual obligations for theatrical releases in its proposed acquisition, critics are skeptical given its reliance on online streaming.

Some trade groups have warned that consequences of either deal could include job losses. Layoffs tied to restructuring are common following a merger and wouldn’t likely draw antitrust scrutiny, but Speta notes competition concerns could still arise if a company “becomes so big that it has purchasing power” and is deemed to control wages more broadly.

A Netflix sign is displayed atop a building in Los Angeles, Thursday, Dec. 18, 2025, with the Hollywood sign in the distance. (AP Photo/Jae C. Hong)

For Paramount specifically, there’s also the news and broader cable landscape to consider.

Attorneys like Wagner expect the prospect of having Warner-owned CNN and Paramount’s CBS under the same roof will be brought up in the regulatory review. But he doesn’t believe it will carry the same weight as streaming and content library questions — or become a tipping point that will lead to the merger’s demise overall.

Similar to broadening the definition of the streaming market, advocates of the Paramount merger will probably point to wider media offerings beyond traditional TV news, including information-sharing on social media platforms, Warner said.

But there are also political implications around a possible CBS-CNN combo. Under new Skydance ownership, Paramount has already taken steps to appeal to more conservative viewers in its news operations, notably with the installation of Free Press founder Bari Weiss as editor-in-chief of CBS News. And if the company’s takeover bid of Warner is successful, many expect similar shifts at CNN — a network that has long attracted ire from Trump.

Trump’s potential role

Trump has been vocal about whether a buyout of Warner will go through, and even said he would personally “be involved in that decision.”

Speta says such a suggestion should raise alarm. While changes in administration have caused shifts in the reach of antitrust enforcement over the years, “presidents picking whether mergers happen or don’t happen is completely unprecedented,” he said.

Earlier this month, Trump said Netflix’s deal “could be a problem” because of the size of the combined market share. The Republican president also has a close relationship with billionaire Oracle founder Larry Ellison — the father of Paramount CEO David Ellison — whose family trust is heavily backing the company’s bid to buy Warner. An investment firm run by Jared Kushner, Trump’s son-in-law, was among other initial contributors to Paramount’s bid, but later backed out.

Meanwhile, Netflix has its own political connections. Trump previously called Ted Sarandos, co-CEO of the streaming giant, a “fantastic man” and said the two met in the Oval Office before the proposed Warner merger was announced. And Trump has continued to publicly lash out at Paramount over editorial decisions at CBS’ “60 Minutes.”

Even without Trump’s intervention, the companies could bruise themselves as the process plays out, according to Paul Nary, assistant professor of management at University of Pennsylvania’s Wharton School of Business. He notes Warner Bros. Discovery has largely unperformed for shareholders since its inception just three years ago — and could “potentially being left in even worse shape” if management is distracted by shuffling through a long, drawn-out deal.

“There’s a potential for the winners curse here,” he said. “Media and entertainment is one of those spaces where you see all of these mega mergers — high stakes (and) big egos competing over the glamorous assets. And so many of those deals end up failing.”