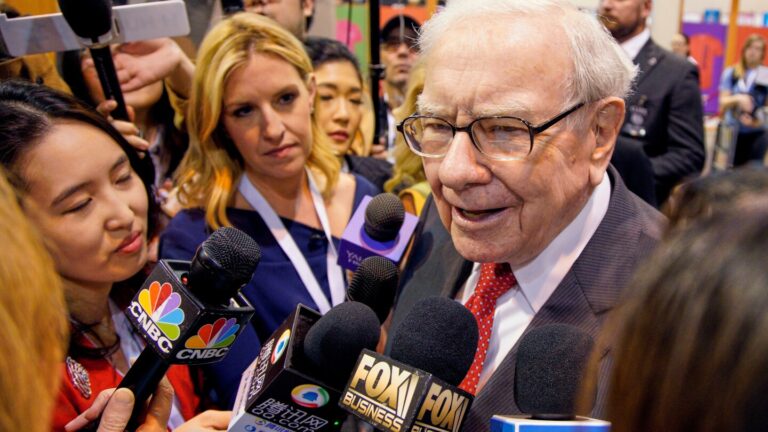

OMAHA, Neb. (AP) — Warren Buffett’s successor appears to be considering his first significant move after taking over as CEO this month.

Kraft Heinz warned investors Tuesday that Berkshire Hathaway may be interested in selling its 325 million shares in the name brand food giant that Buffett helped create back in 2015. The news came in a filing with stock market regulators.

Buffett and the Brazilian investment firm 3G Capital orchestrated the merger of Kraft and Heinz back then because they already owned Heinz and believed in the power of their brands. Now Greg Abel may be plotting a different course.

Over the years since Buffett had come to realize that the company’s competitive moat around its brands wasn’t as strong as he thought as consumers have increasingly been willing to switch to store brands and move away from processed foods. Berkshire took a $3.76 billion writedown on its Kraft-Heinz stake last summer. Buffett said last fall that he was disappointed in Kraft Heinz’ plan to split the company in two, and Berkshire’s two representatives resigned from the Kraft board last spring.

But still it was rare for Buffett to unload an acquisition during his six decades leading Berkshire even when he soured on a business’ prospects. Berkshire didn’t respond to questions Tuesday about the filing where Kraft Heinz disclosed that its largest shareholder “may offer to sell, from time to time, 325,442,152 shares.” Kraft Heinz shares fell nearly 4% to $22.85 after the announcement.

There’s no sign Berkshire has started selling yet, but CFRA Research analyst Cathy Seifert wonders if this could be just the beginning of a comprehensive review of Berkshire’s varied holdings. In addition to its massive stock portfolio worth over $300 billion, Berkshire owns an assortment of insurers including Geico, several utilities, BNSF railroad and an eclectic mix of manufacturing and retail companies.

“My sense is that Greg Abel’s leadership style may be a departure from Buffett’s, and this sale, if completed, would represent a shift in corporate mindset,” Seifert said. “Berkshire under Buffett typically only made acquisitions- not divestitures. It’s not inconceivable, in our view, that Abel may likely assess every Berkshire subsidiary and decide to jettison those that do not meet his internal hurdles.“

Of course Abel already knows many of Berkshire’s companies well because he has been managing all of the non-insurance companies since 2018. But he only became CEO on Jan. 1. Buffett remains chairman, but investors are watching closely for any changes Abel might make at the venerable conglomerate.

Investor Chris Ballard, who is managing director at Check Capital, said “selling Kraft is probably the most low-hanging fruit for Greg. We personally wouldn’t be sad to see the holding go.”

But of course it would be bard for Berkshire to unload all of its shares on the public market because it is such a large stake, so Ballard said he wonders if there could be a large prospective buyer in the wings.

But Buffett said last fall that Berkshire wouldn’t accept a block bid for its shares unless the same offer was made to all Kraft Heinz shareholders.