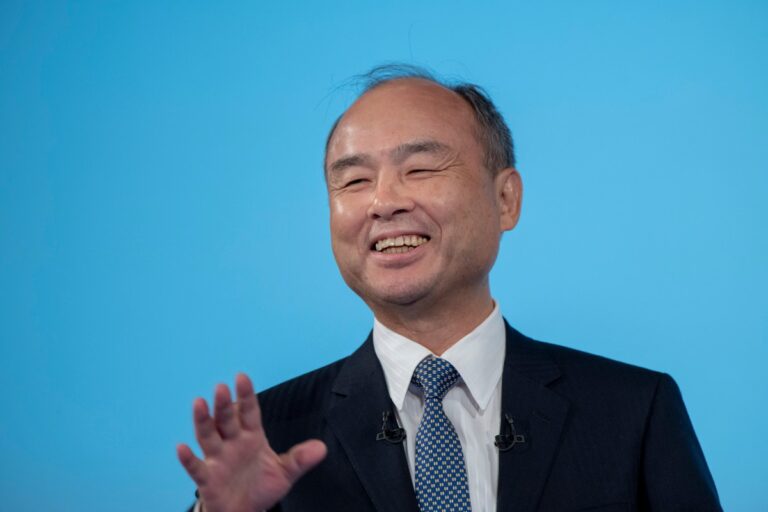

Masayoshi Son isn’t known for half measures. The SoftBank founder’s career has been studded with brow-raising bets, each one seemingly more outrageous than the last. His latest move is to cash out his entire $5.8 billion NVIDIA stake to go all-in on AI, and while it surprised the business world on Tuesday, it maybe should not. At this point, it’s almost more surprising when the 68-year-old Son doesn’t push his chips to the center of the table.

Consider that during the late 1990s dot-com bubble, Son’s net worth soared to approximately $78 billion by February 2000, briefly making him the richest person in the world. Then came the ugly dot-com implosion months later. He lost $70 billion personally – which, at the time, was the largest financial loss by any individual in history — as SoftBank’s market cap plummeted 98% from $180 billion to just $2.5 billion.

But amid that terribleness, Son made what would become his most legendary bet: a $20 million investment in Alibaba in 2000, one decided (the story goes) after just a six-minute meeting with Jack Ma. That stake would eventually grow to be worth $150 billion by 2020, transforming him into one of the venture industry’s most celebrated figures and funding his comeback.

That Alibaba success has often made it harder to see when Son has stayed too long at the table. When Son needed capital to launch his first Vision Fund in 2017, he didn’t hesitate to seek $45 billion from Saudi Arabia’s Public Investment Fund – long before taking Saudi money became acceptable in Silicon Valley. After journalist Jamal Khashoggi was murdered in October 2018, Son condemned the killing as “horrific and deeply regrettable” but insisted SoftBank couldn’t “turn our backs on the Saudi people,” maintaining the firm’s commitment to managing the kingdom’s capital. In fact, the Vision Fund actually ramped up dealmaking soon after.

That didn’t turn out so well. A big bet on Uber generated paper losses for years. Then came WeWork. Son overrode his lieutenants’ objections, fell “in love” with founder Adam Neumann, and assigned the co-working company a dizzying valuation of $47 billion in early 2019 after making several previous investments in the company. But WeWork’s IPO plans collapsed after it published a famously troubling S-1 filing. The company never quite recovered – even after pushing out Neumann and instituting a series of belt-tightening measures – ultimately costing SoftBank $11.5 billion in equity losses and another $2.2 billion in debt. (Son reportedly later called it “a stain on my life.”)

But Son has been mounting another comeback for years, and Tuesday will undoubtedly be remembered as an important moment in his turnaround tale. Indeed, it will likely be recalled as the day SoftBank sold all 32.1 million of its NVIDIA shares – not to diversify its bets but instead to double down elsewhere, including on a planned $30 billion commitment to OpenAI and to participate (it reportedly hopes) in a $1 trillion AI manufacturing hub in Arizona.

If selling that position still gives Son some heartburn, that’s understandable. At approximately $181.58 per share, SoftBank exited just 14% below NVIDIA’s all-time high of $212.19, which is a strong look. That’s remarkably close to peak valuation for such a huge position. Still, the move marks SoftBank’s second complete exit from NVIDIA, and the first one was exceedingly costly. (In 2019, SoftBank sold a $4 billion stake in the company for $3.6 billion, shares that would now be worth more than $150 billion.)

Techcrunch event

San Francisco

|

October 13-15, 2026

The move also rattled the market. As of this writing, NVIDIA shares are down nearly 3% following the disclosure, even as analysts emphasize that the sale “should not be seen as a cautious or negative stance on Nvidia,” but rather reflects SoftBank needing capital for its AI ambitions.

Wall Street can’t help but wonder: does Son see something right now that others do not? Judging by his track record, maybe — and that ambiguity is all investors have to go on.